By: Paige Wickline, Director of Finance![]()

Fiscal Year 2026 is a 53-week year, with one additional week of sales and labor costs. Every five years, we have a 53-week year per our bylaws: “The fiscal year of the Co-op shall be from the first Monday nearest June 30th to the Sunday nearest June 30th next, for a revolving 52/53-week cycle. FY26 runs June 30, 2025 through June 29, 2026.

Since the spring of 2024, everyone at our Co-op has worked to position ourselves to have a small profit in FY26. This included extensive focus on when and how staff are scheduled to work, along with a review of all our expenditures. In addition, our sales growth was double what we had anticipated in FY25, which allowed us to become profitable beginning in FY25Q2 and lay the groundwork for small profits in FY26.

Operating Budget

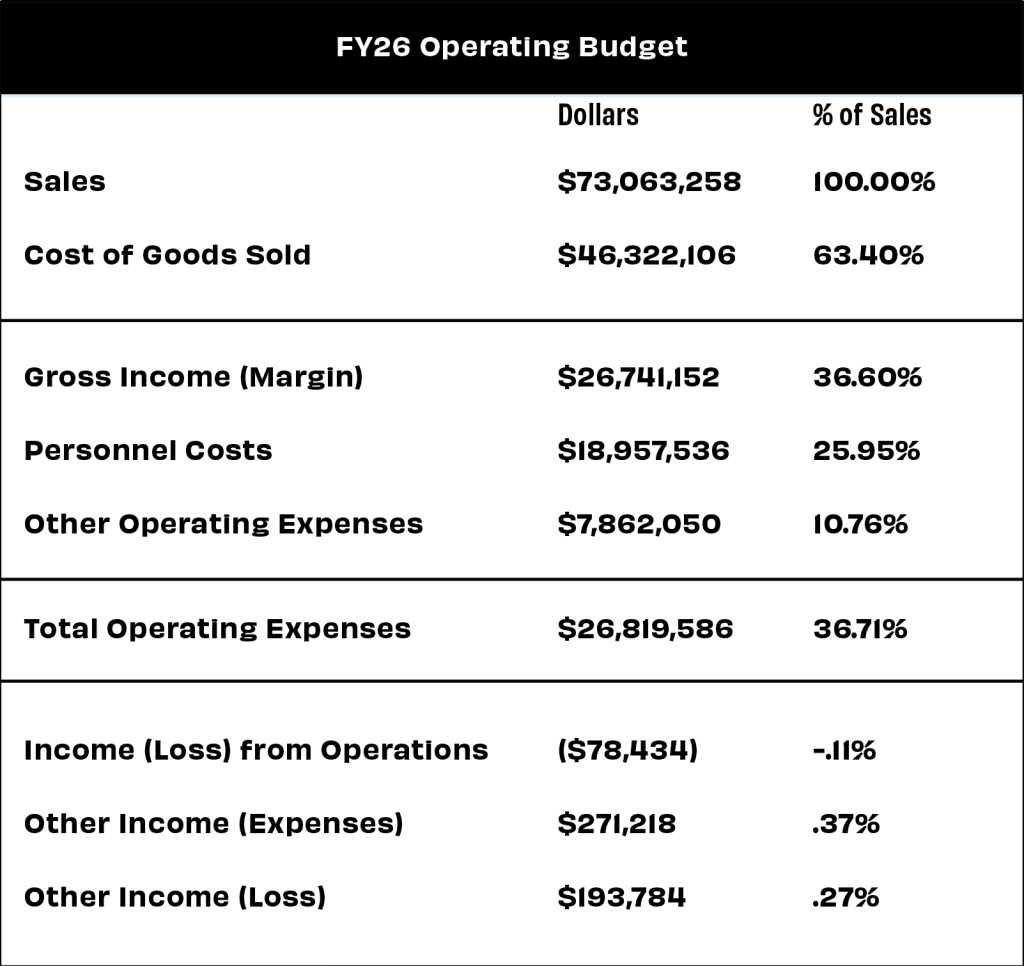

Our operating budget is a projection of sales revenue, wages and benefits, and all other expenditures to run our Co-op. This budget is the blueprint that guides our expenses and focus for the year.

Total Sales

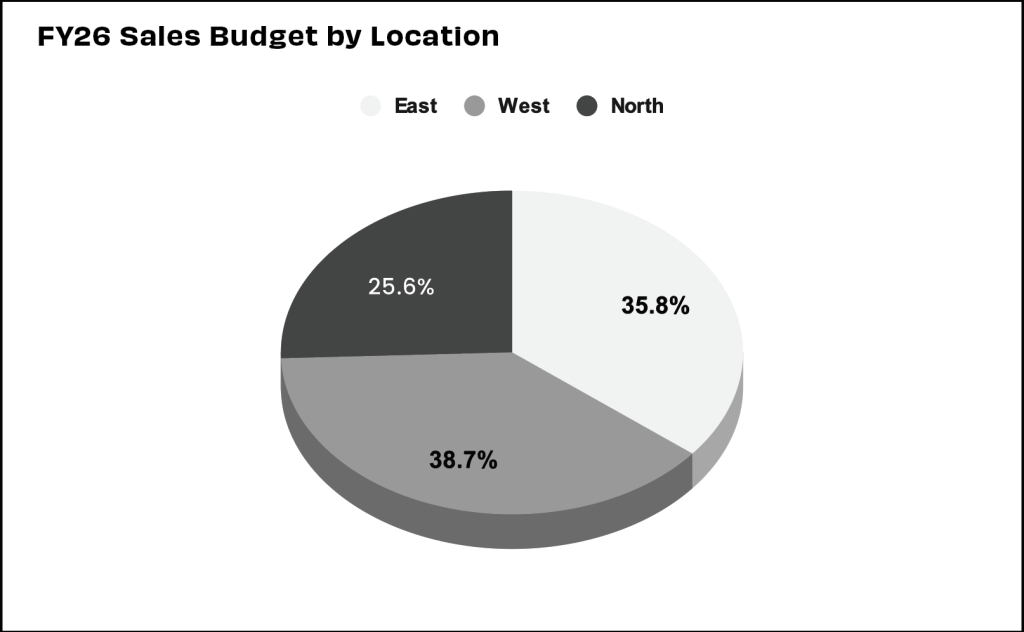

The FY26 sales projections for our Co-op include 2.9% sales growth over the previous year, after adjusting for FY26 having one additional week of sales compared to FY25. Sales growth will come from increased transactions across three retail sites, with a slight increase in the amount folks spend each time they shop.

We project that 38.7% of our sales will come from our Middleton location, 35.7% from our East location, and 25.6% from our North location. North’s sales continue to increase faster than at our other locations and are budgeted to grow 6.47% this year compared to the previous year.

Gross Income (Margin)

Gross Income refers to the percent of sales dollars remaining after subtracting the cost of goods sold (COGS). Gross Income is the money used to pay for our operations. Gross Income can also be expressed as a percent of sales.

There are no significant changes in the budget with COGS or our Gross Margin %. We continue to monitor the impact of tariffs and immigration practices on our cost of goods sold.

Our gross income, expressed as a percent of sales, is budgeted at 36.6%, which is a slight increase over the previous year. To achieve this, we will continue to work on reducing our costs of the products we buy through quantity purchase discounts and monitoring our sales mix.

Personnel

Personnel expenses include wages for worked hours, paid time off, and benefits. These costs are budgeted to be 25.95% of sales. We remain focused on aligning labor with our sales revenue. This includes maintaining labor hours as sales grow, so the additional sales revenue is available to cover the rising costs of benefits and annual wage increases.

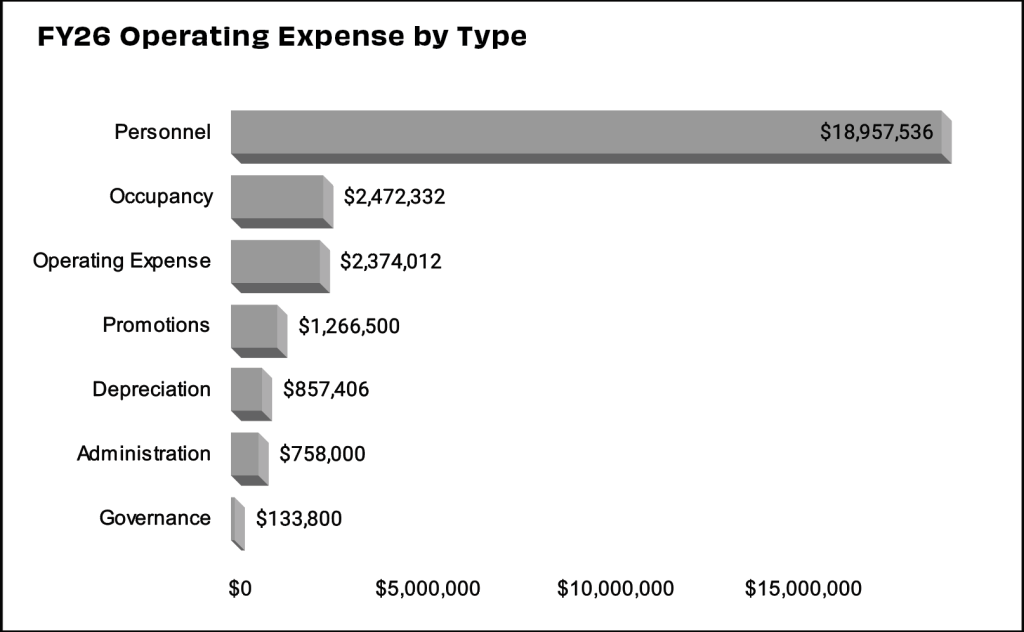

Other Operating Expenses

Other expenses for running our Co-op include costs related to Occupancy, Operations, Promotions, Depreciation, Administration, and Governance. The total budget for all of these categories is $7,862,050 in dollars and 10.76% of sales. Other operating expenses are down from the previous year as a percent of sales by .50%.

Income From Operations

Our income from operations is budgeted at a loss of ($ 78,434) or -.11% of sales. This is because we are projecting sales growth to be less than FY25, while personnel expense growth will hold steady.

Budget Focus

Our FY26 focus remains on our long-term financial sustainability. This focus includes an emphasis on how to maximize sales and revenue growth, as well as the ongoing alignment of our personnel expenses with revenue.

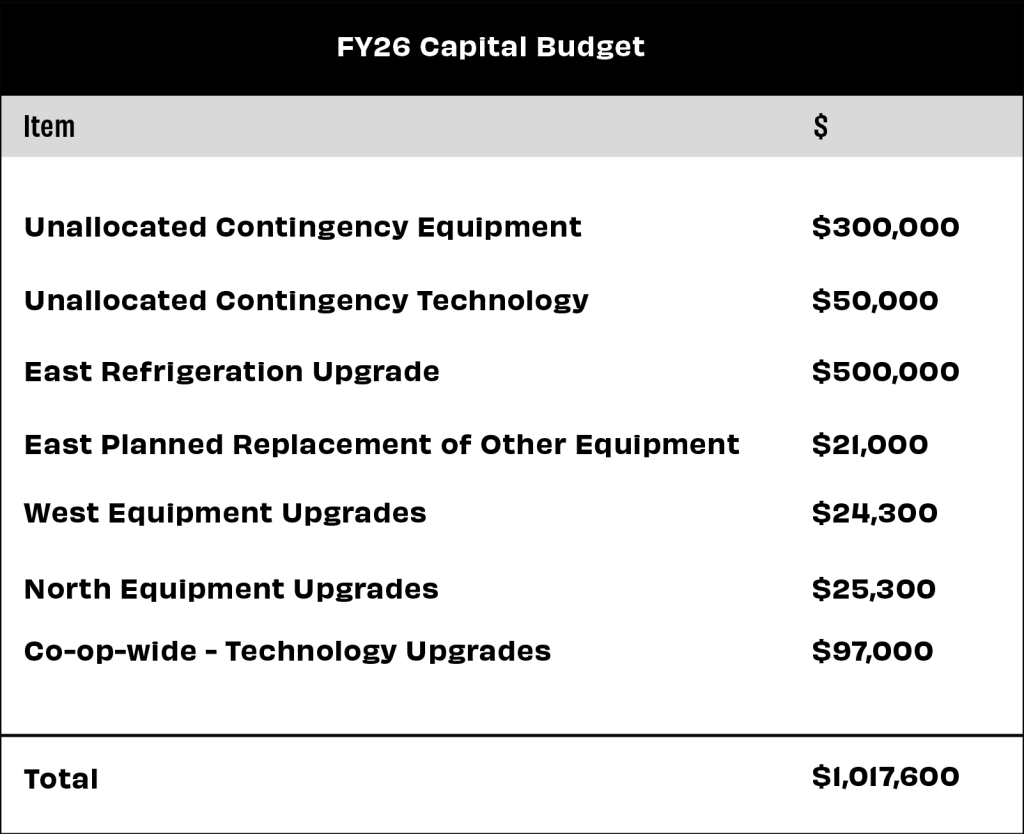

Capital Budget

The FY26 capital budget is $1,017,600. These items are purchases that will be listed on our Balance Sheet as Long-Term Assets of property and equipment when they are purchased. Our major capital investment in FY26 is a refrigeration upgrade at Willy East. This upgrade allowed us to replace old refrigerants and equipment with more environmentally friendly alternatives.

We thank you for your ongoing patronage and support. If you have any questions regarding the FY26 budget, feel free to email me at p.wickline@willystreet.coop.